Do you sometimes look pitiful at pensioners because you think they are somewhat poor? Some of them might be and in 20 years from now, you would wish your pension was being remitted in crypto. I don’t want you to have that regret, so I’ll explain.

Your pension is the amount remitted to an account by both the employer and the employee with the employer paying the larger amount – showing a commitment that they care about life after retirement for you. Except if you earn in foreign currency, that amount is usually remitted in your local denomination.

This means that your retirement and your future plan are tied to the trend of your country’s currency. By now you should start thinking about different economic and non-economic policies that could affect your currency like devaluation and depreciation. Both do one thing – reduce the value of the local currency and thus bring inflation. People realise there is inflation where the local currency reduces its purchasing power. The word on the streets is that things are expensive. This automatically affects every investment or asset you have in your currency including your pension.

An Intentional look at Pension Investments

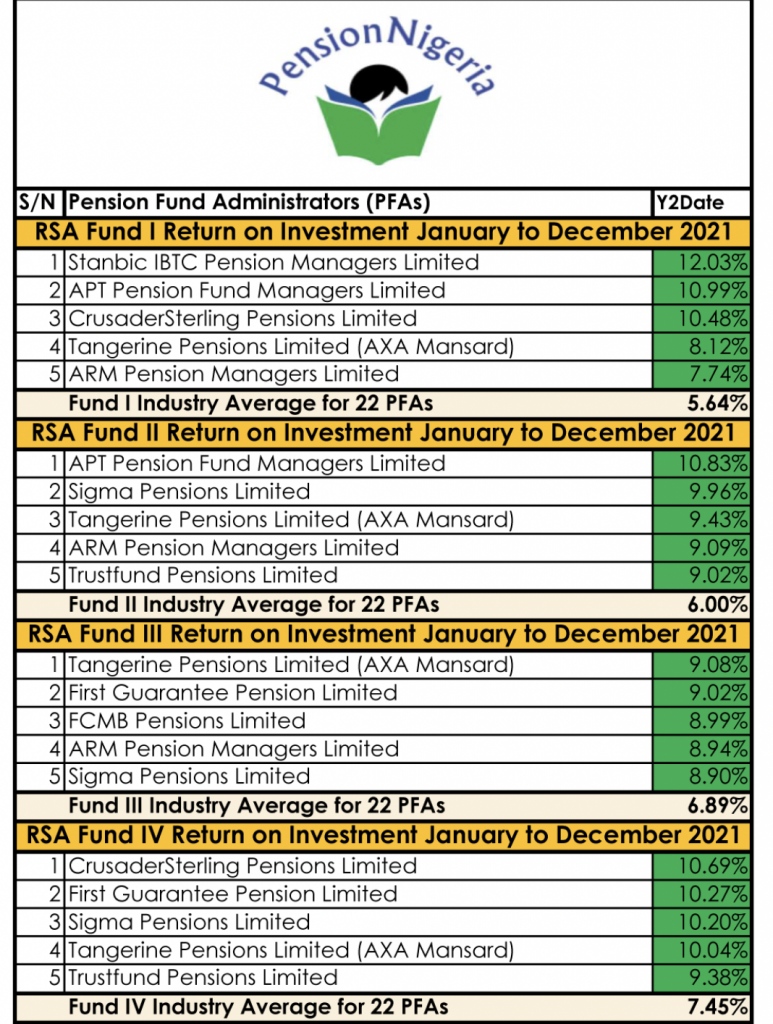

If you’re lucky enough, your employer can undertake to contribute all your pension. Typically, Pensions paid by you(8% of your salary) and your employers (10% of your salary)go to an account called a pension fund and are supervised and managed by Pension managers and advisers. They don’t just save your money but promise a percentage that is compounded over a period of time. Returns are quite competitive among the different pension funds manager. Sometimes return can be as high as 20%. However, in 2021, the average return was between 5-8%.

This is after these pension administrators invested in Government bonds, the Nigerian stock market, local money market and mutual funds. By now you should be interested in knowing the returns of your pension manager. Many employees passively receive their alerts monthly and are less concerned about how they are doing. You should be.

Is Crypto any good?

In a situation where a country is grappling with double figure inflation, you can weigh the figures on your ROI and project if your pension investment is really worth it or you’re losing money as much as you make it. What if your pension is remitted in Crypto like USDT which is a stable coin and pegs 1:1 to the dollar? It means your pension is protected from currency devaluation or depreciation. Meanwhile, Bitcoin has been up in 5 figures of growth since 2009. What if your pension was being remitted in Bitcoin? Some might even just retire because of the kind of returns their pension would have accumulated. However, there are regulations that govern work places and that may not be feasible to implement right away.

What can you do?

If you’re fortunate to work in firms that comply with pension remission scheme, that is great. Having seen the limitation of this plan, you need an alternate investment in form of crypto. A great place to start is by having the Yellow Card App (available on the Google playstore and Apple App store) which offers the simplest interface to understand when buying crypto assets. After you have registered on the App and done all necessary verifications.Start by saving half the amount remitted to your pension fund in USDT, which is 9%. Or you can go further to buy Bitcoin which has shown no signs of slowing down since it’s inception in 2009. When you compare the returns from your pension to this in a few years time, you would wish you added more money buying crypto assets.

Read More: Pan-African Cryptocurrency Exchange, Yellow Card Unveils New Brand Identity

Article was written by Timothy Ukaegbu.

Note: Yinksmedia does not recommend that any cryptocurrency should be bought, sold, or held by you. We advise you to trade cryptocurrency safely and invest wisely.