Carbon, a credit led Pan-African digital bank today released Carbon Zero, a buy now, pay later web app which helps customers spread the cost of purchases into interest-free instalments, in-store or online. Since its inception in late 2021, Carbon Zero has generated ₦2.3 billion in requests from 41,000 customers who have applied for a spending limit.

Instant Approval

Using proprietary technology Carbon has been developing and improving throughout their 10 years as a credit provider, Carbon’s decision engines can automatically assess affordability and give accurate credit decisions in seconds. By simply sharing their BVN and bank account number, millions of people can make purchases with interest-free credit seamlessly.

Market-Leading Spend Amounts

Based on affordability, Carbon Zero allows customers to spend up to N2.5m with Carbon Zero. This is far higher than the spend limits offered by competitors, with most being somewhere between ₦150,000 and ₦500,000. This of course makes Carbon Zero the de-facto choice for customers with higher purchasing power.

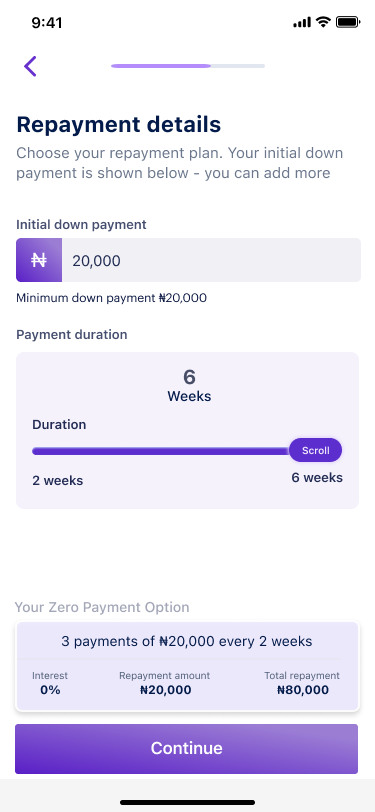

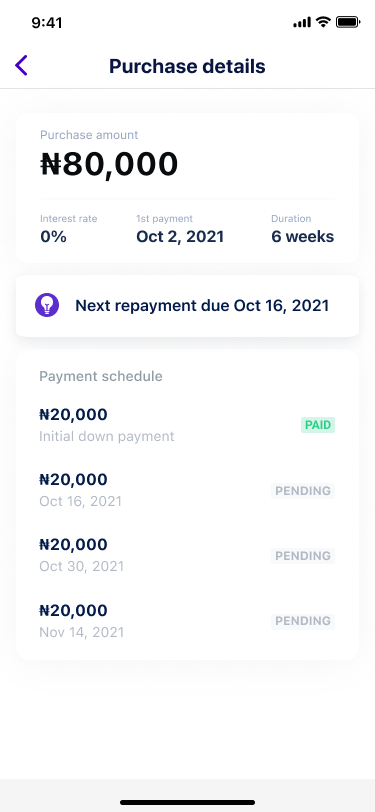

The Best Interest Rate: 0%

This one’s easy to explain. Carbon Zero literally charges ZERO percent interest on all purchases which are repaid on time and in full in 3 instalments giving Carbon Zero an edge over competing BNPL providers that charge interest for short tenors.

“We believe that having access to credit and good financial services is a fundamental human right. The costs of basic goods and services are rising and increasingly out of reach for customers, so it’s natural that people need help with financing what we consider everyday modern necessities.” Chijioke Dozie. CEO, Carbon.

Read Also: Quickteller Business unveils Smart PoS for African businesses

About Carbon

Carbon is a credit-led, Pan-African digital bank. The company’s headquarters are in Lagos, Nigeria, with operations in Nigeria, Ghana, and Kenya, Carbon is a worldwide corporation with over 150 employees.

Founded in 2012 as One Credit to give loans to salary earners in Lagos, then introducing a raft of alternative services like bill payments, airtime purchases, and issuing free credit reports to users.

Today, Carbon offers a zero-fee current account that yields interest and cashback on card purchases right out of the box. Plus unsecured loans and investment plans of up to 14.5% per annum. With Zero, the startup aims to further its mission of providing modern credit products and building value-based relationships with customers.